Help Button Free Stock Photo Public Domain Pictures

Applying for and using an ITIN. If you're working and earning money in the United States, but you don't have and don't qualify for a Social Security Number, you'll need an ITIN. You can apply for an ITIN tax ID for you, your spouse, and your dependents when you prepare your tax return with us. Here's what an ITIN can help you do.

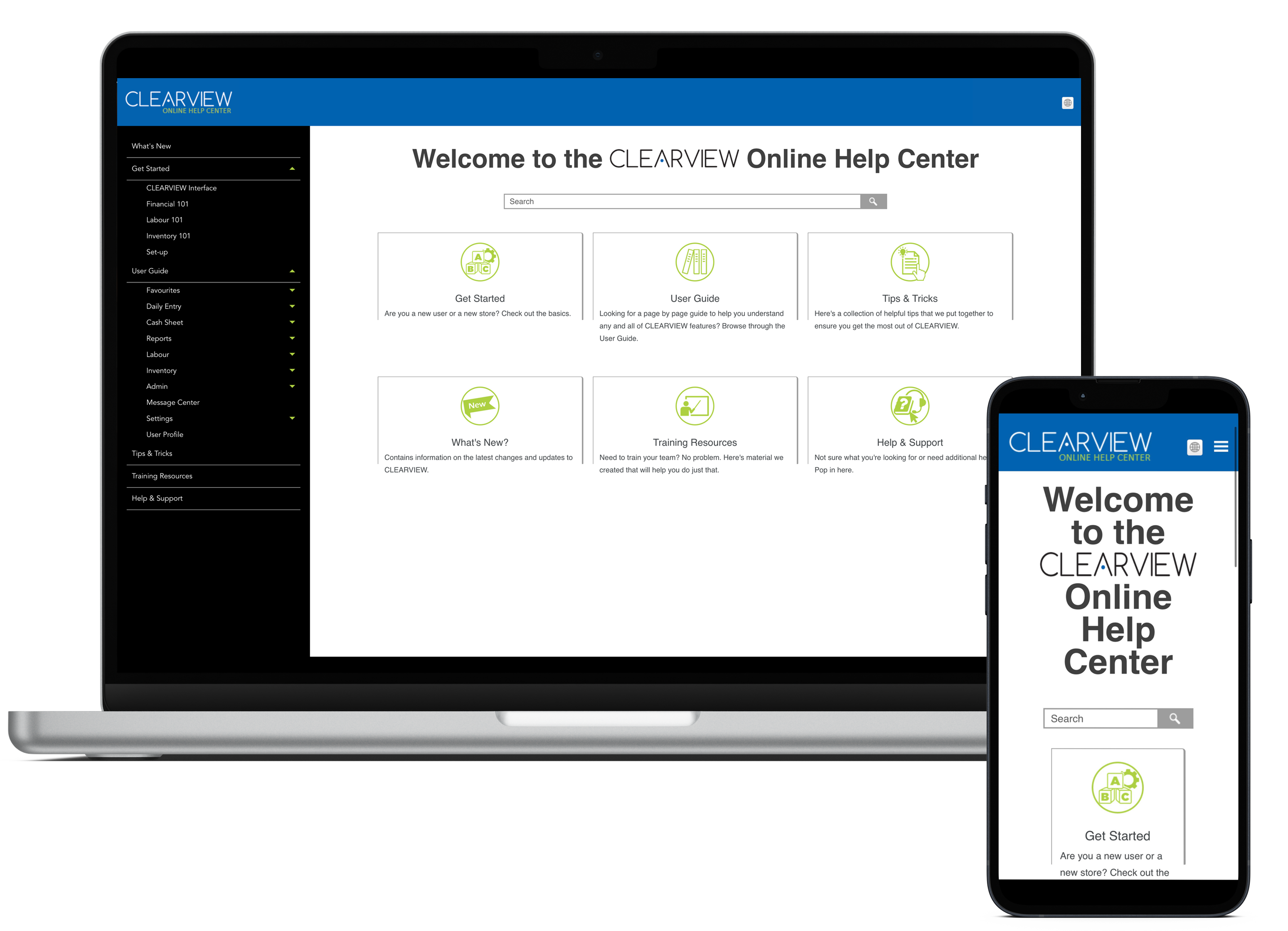

Quick Service Software

ITIN holders pay taxes. ITINs let people without SSNs pay taxes. According to the IRS, in 2015, "4.4 million ITIN filers paid over $5.5 billion in payroll and Medicare taxes and $23.6 billion in total taxes.". ITIN holders are not eligible for all of the tax benefits and public benefits that U.S. citizens and other taxpayers can receive.

When someone asks, can you help kme? I will say I can. Can you help

Strategic insights. Flexible solutions giving educators the freedom to design and deliver student assessments their way - with integrity and confidence. Foster original thinking Help develop students' original thinking skills with high-quality, actionable feedback that fits easily into teachers' existing workflows. Customer stories

About Us Tin Tribe Media company

A Taxpayer Identification Number (TIN) is a unique nine-digit number the Internal Revenue Service uses to identify individual taxpayers.

some white lgbtq+ people in 2021 Cry for help, Mood pics, Fb memes

Ting Mobile. Nationwide LTE on America's largest networks. Signing up for Ting Internet. Ting Fiber Internet construction FAQ. Set your Ting Router's Wi-Fi Network Name and password. Ting's price plans. FAQ: monthly billing.

Help Scrolller

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN).

Help 2 Free Stock Photo Public Domain Pictures

A Tax Identification Number (TIN) is a nine-digit tracking number assigned and used to identify a taxpayer. If you receive an income, or have any reportable or otherwise taxable activity (in the.

Help Free Stock Photo Public Domain Pictures

ExamSoft. Digital assessment platform for secure exams that produces actionable data to improve exam-taker learning outcomes. Search and browse help articles and guidance for the Turnitin product suite.

Help

Individual Taxpayer Identification Number (ITIN) is a tax ID number individuals who are required to have a U.S. Taxpayer Identification Number but who do not have one and are not eligible to get an SSN must apply for. You need an ITIN to file your taxes and open a U.S. bank account when you don't have a Social Security Number (SSN).

Need help button stock vector. Illustration of customer 137914934

Tinnitus fills your ears with sounds no one else hears. It's a common issue affecting more than 50 million people in the United States. Tinnitus can be severe, affecting people's daily lives. Tinnitus isn't a disease. It's a symptom of several medical conditions. Healthcare providers can't cure tinnitus, but they can help manage its.

Tolong Font Teriakan Minta Gambar gratis di Pixabay

tin.it supports IMAP / SMTP Watch on YouTube: "tin.it supports IMAP / SMTP" That means you don't have to use tin.it webmail interface! You can check your emails using other email programs (like Mailbird, Microsoft Outlook or Mozilla Thunderbird).Using desktop email programs will make you more productive and your email will always be available, even offline.

Help Button Red · Free vector graphic on Pixabay

An Individual Taxpayer Identification Number (ITIN) is a nine-digit number issued by the IRS to be used on a tax return. You need this number if you're required to file a tax return and you don't have and aren't eligible to get a Social Security number (SSN).

Free illustration Help, Font, Cry For Help, Note, Sos Free Image on

The On-Line Taxpayer Identification Number (TIN) Matching Program is a free web-based tool offered by the IRS through e-Services and was established for payers of reportable payments subject to the backup withholding provisions of section 3406 of the Internal Revenue Code. This program allows a participant to check the TIN furnished by the.

help_tip1.png

A Tax Identification Number (TIN) is a nine-digit number used as a tracking number by the Internal Revenue Service (IRS). It's required information on all tax returns filed with the IRS.

[f] I'm thirsty! Will you give me milk? Scrolller

Area Clienti Tin.it | Telecom Italia. Inserisci un indirizzo email @tin.it o la UserID di navigazione nel campo Username, e la relativa password nel campo Password. Home | Mail. Username Password. Assistenza - Le risposte alle tue domande su tanti argomenti del mondo Tin.it.

Help Wanted rubber stamp stock illustration. Illustration of attendance

A tax identification number, sometimes also called a "TIN number," is a unique nine-digit number that identifies you to the IRS. It's required on your tax return and requested in other official.